Formal complaint period remains open for 2023 reappraisals

by Judy Stringer

Summit County fiscal administrators are bracing for another round of reappraisal complaints.

Property owners – some of which saw their property values soar by 30% and 40% in the 2023 reappraisal – have until March 31 to formally challenge those valuations. Nearly 8,000 have already done so during an informal complaint period late last summer.

Of the 7,952 informal complaints filed, 62% resulted in a valuation change, according to Dominic Basile, director of real estate and appraisal for the Summit County Fiscal Office.

“Those were decreases for the most part,” he said. “We had a few people request that we review their value to see if it should be higher, so I think we had about seven requests to go up.”

Basile explained that counties are required by state law to conduct “full” property appraisals, which consider factors like current construction costs in addition to property sales data, every six years. The last Summit County “sexennial” reappraisal occurred in 2020.

The 2023 reappraisals were a mid-point update – also per Ohio statute – to those more in-depth assessments and based entirely on recent sale prices.

“We looked at what homes were selling for in 2022 compared to what they sold for in the full reappraisal back in 2020,” he said, “and we applied adjustments to that entire neighborhood or sub-market. … So, one particular neighborhood may have gotten a 20% increase and another one maybe a 15% increase or maybe 30%. It just depended on what those sales showed us.”

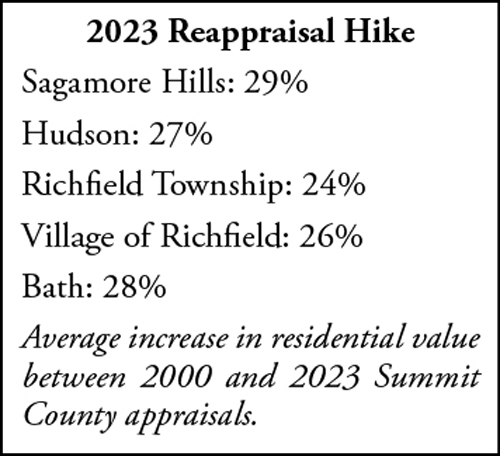

Overall, Summit County property owners saw a 31.4% hike in the value of their homes. Increases to property values in the ScripType readership area ranged between 24% in Richfield Township to 29% Sagamore Hills (see chart).

Basile said “leaning” on property sales from a single year – in this case 2022 – is a newer requirement coming from the state. Prior to the 2020 sexennial reappraisal, fiscal offices would analyze three years of sales data in considering new valuations.

“The state also issues an order explaining exactly what they expect to see,” he continued. “They ordered us to resize by 34%. We looked at the numbers and luckily, thankfully, they accepted our submittal at 31.4%.”

Jack Burgess Jr., director of the Summit County Fiscal Office’s Board of Revision, predicts the board could field as many as 6,000 formal valuation complaints over the next three months, which “logically will be a challenge for a small office like ours.”

After the 2020 reappraisal, when the county saw a 12% bump in property values overall, some 3,700 homeowners submitted a formal complaint, according to Burgess. This time around, however, residents were invited to one-on-one meetings to discuss their valuations and file informal disputes during an August and September “roadshow.” Burgess said he is hopeful that process will temper the number of formal filings.

Following the money

As of press time, the fiscal office was not able to project how much additional revenue local agencies will net from the valuation increases. In an email, Deputy Fiscal Officer Christina Balliet said estimates would not be possible until “we receive the tax rates and reduction factors from the State of Ohio Department of Taxation.” Those figures were expected by early January.

Typically, county reappraisals do not result in big gains for agencies that receive their collections because of a state law meant to keep property taxes from inflating with values. Yet, a small portion of property assessments, called inside millage, is allowed to rise with property values, and given the steep increases seen across the county, the revenue bump could be more substantive than usual, especially for school districts who get the lion’s share of these taxes.

During his five-year forecast to the Hudson City School Board in November, district Treasurer Phil Butto said that while revenue growth from inside millage adjustments is “minimal” in most cases, “the growth is actually material this year due to the increase in values.”

Revere Local School District Treasurer Rick Berdine speculated the need for a new operating levy might be delayed due in part to revenue from property value growth. “No one anticipated, myself included, that we would have double digit valuation increases in 2020 and bigger double digit increases in 2023,” Berdine told the Revere board during a Nov. 14 work session. “We’re looking at about 26% overall for our district. Between that and $1.2 million in additional state revenue … it’s a big kick in a nice way.”