Sponsored

Inflation & Your Investment Portfolio Part 1

by Kevin Kroskey, CFP®, MBA

Understandably, the reemergence of inflation is upsetting to many Americans. Huge price increases in red meat, cars and gasoline and far more modest price increases among many other consumer goods and services reflect the distinctive nature of the recent rise in consumer prices. No doubt your investment portfolio is more vulnerable to higher inflation today compared to the last few decades.

The stakes for bonds with fixed cash flows are straightforward. Interest rates remain low in the U.S. and much of the developed world. If inflation further spikes or remains near current levels for an extended period, central bankers will be forced to continue to raise short-term rates. Consensus estimates indicate another 1.5% increase in the Federal Funds Rate by year’s end.

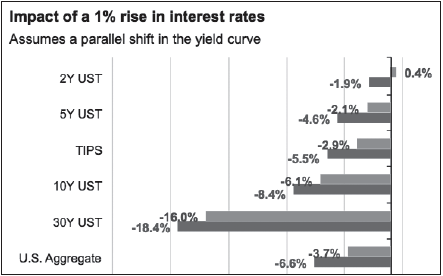

Long-term rates may or may not proportionately follow, as central banks have less impact here, but it’s trouble for most bonds either way. You can see this in the graphic. The two bars represent the total return (top bar) and the price return (bottom bar) for each type of bond investment. Only the shortest term, a two-year U.S. Treasury Bond, has a positive total return. (Reminder: the total return you receive on any investment is the yield plus or minus the price return.)

The impact of higher inflation on stocks is harder to know. Unlike bonds, the influence of interest rates on stock prices isn’t entirely obvious. While bonds offer fixed cashflows, stocks have yielded growing cash flows over time, which tend to fend off inflation.

More recently, you most likely have heard the narrative that low interest rates justify high stock valuations. The rationale is that long-dated future cash flows that investors can expect to receive are worth more today because low interest rates reduce (aka discount) their future value by a lesser degree. This rationale is debatable, but investors have seemingly behaved as if it were absolute.

Supposing the rationale continues, this may imply more severe pain for stocks. The S&P 500, for instance, is trading at approximately 20 times earnings with a paltry dividend yield of less than 2%. Over the last 20-years, on average, it has traded at 15 times earnings – a 25% discount relative to today.

Considering the high multiple and low yield of the S&P 500, some estimates have it being much more negatively impacted than the 30-year U.S. Treasury in a rising rate environment that may lack economic growth to propel cashflows.

While you undoubtedly have enjoyed tame inflation, increasing economic growth, and higher stock prices beefing up your 401k over the last 10-plus years, you should never solely rely on any economic regime to dominate your portfolio or forsake diversification. Instead, the foundation of good long-term investing must be built on evidence and diversification that incorporates many different market environments – an all-weather portfolio if you will. More on this next month…

Sponsored by

True Wealth Design

Kevin Kroskey, CFP®, MBA is President of True Wealth Design, a wealth management firm with deep expertise in retirement, tax, and investment planning, providing complete integration of your financial life. Kevin can be reached by calling 330-777-0688 or by email at kkroskey@truewealthdesign.com and offers a complimentary initial consultation.

Opinions and claims expressed above are those of the author and do not necessarily reflect those of ScripType Publishing.